Little Known Questions About 10 2 10 3.

Wiki Article

The Single Strategy To Use For 10 2 10 3

Table of ContentsThe 4-Minute Rule for 10 2 10 3Some Of 10 2 10 3The Greatest Guide To 10 2 10 3The Of 10 2 10 3The smart Trick of 10 2 10 3 That Nobody is Discussing10 2 10 3 Things To Know Before You Buy

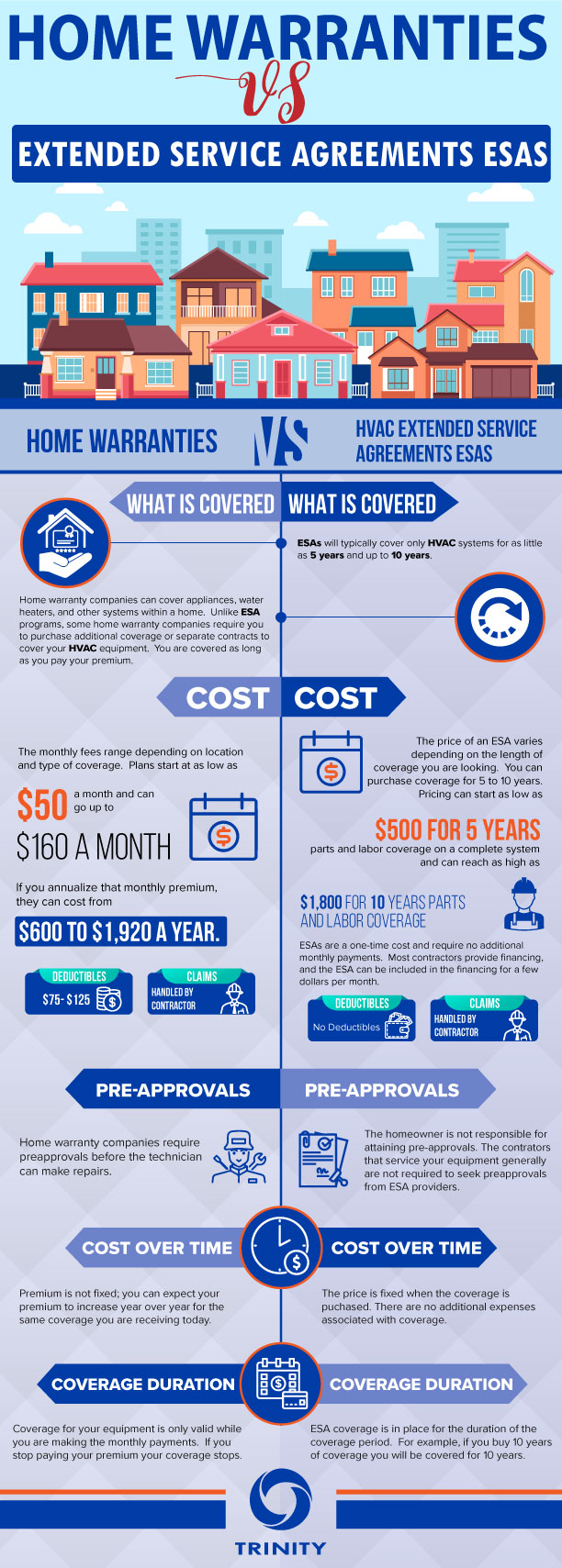

House insurance coverage might also cover medical expenditures for injuries that people sustained by being on your building. A home owner pays a yearly costs to their homeowner's insurer. Generally, this is someplace in between $300-$1,000 a year, depending upon the plan. When something is harmed by a calamity that is covered under the house insurance coverage, a homeowner will certainly call their home insurance policy company to sue.Property owners will generally have to pay an insurance deductible, a set quantity of money that comes out of the homeowner's budget prior to the residence insurer pays any type of cash towards the case. A home insurance policy deductible can be anywhere in between $100 to $2,000. Typically, the greater the deductible, the reduced the annual premium price.

What is the Distinction Between Residence Guarantee and also House Insurance A house guarantee contract and a house insurance coverage operate in comparable ways. Both have an annual premium and also an insurance deductible, although a residence insurance policy premium and also insurance deductible is usually much greater than a house guarantee's. The main distinctions in between house guarantees and home insurance are what they cover.

What Does 10 2 10 3 Do?

Another difference in between a residence warranty as well as home insurance policy is that residence insurance coverage is normally required for home owners (if they have a mortgage on their residence) while a house warranty plan is not required. A residence guarantee as well as home insurance policy give security on different components of a house, and with each other they can secure a house owner's budget from pricey repairs when they unavoidably turn up.If there is damages done to the structure of your home, the owner will not need to pay the high costs to fix it if they have residence insurance coverage. If the damages to the home's structure or homeowner's possessions was caused by a malfunctioning devices or systems, a home service warranty can assist to cover the expensive repair services or replacement if the system or appliance has fallen short from typical deterioration (10 2 10 3).

They will collaborate to supply defense on every part of your home. If you have an interest in buying a residence guarantee for your house, take an appearance at Spots's home guarantee plans as well as rates here, or request a quote for your residence right here.

Indicators on 10 2 10 3 You Need To Know

In a hot vendor's market where residence buyers are forgoing the house inspection contingency, purchasing a house warranty could be a balm for stress over possible unknowns. To get the most out of a home service warranty, it is necessary to check out the small print so you understand what's covered and also exactly how the strategy works before subscribing.The difference is that a home service warranty covers a variety of things instead of just one. There are 3 standard sorts of house warranty strategies. System prepares cover your residence's mechanical systems, including heating as well as cooling, electric as well as plumbing. Appliance plans cover significant devices, like the dishwashing machine, oven and washing machine.

Some products, like in-ground sprinklers, pool as well as septic tanks, may need an added service warranty or may not be covered by all residence warranty business. When contrasting house service warranty business, ensure the plan options incorporate whatever you would certainly desire covered.New construction residences commonly featured a warranty from the contractor.

10 2 10 3 Things To Know Before You Buy

To put it simply, if you're acquiring a house and also a problem shows up during the house examination or is kept in mind in the seller's disclosures, your home warranty company might not cover it. Instead of relying exclusively on a service warranty, try to discuss with the seller to either treat the concern or give you a debt to assist cover the price of having it repaired.

Some Known Details About 10 2 10 3

For one, house owners insurance policy is needed by loan providers in order to obtain a why not find out more mortgage, while a residence service warranty is entirely optional. As discussed above, a residence service warranty covers the fixing as well as replacement of items and also systems in your house.

Just how much does a residence service warranty expense? House service warranties usually set you back between $300 and $600 annually; the price will vary depending upon the sort of plan you have. The extra that's covered, the costlier the strategy those attachments can accumulate. Where you live can additionally affect the cost.

The Ultimate Guide To 10 2 10 3

Though you won't pay for the real fixings, you will pay a service fee every single time a tradesperson involves your residence to examine a problem. If greater than one pro is called for, you might end up paying a solution fee even more than once for the very same job. This cost can range from regarding $60 to $125 for each service instance, making the service charge recommended you read another point to consider if you're purchasing a house guarantee plan.Report this wiki page